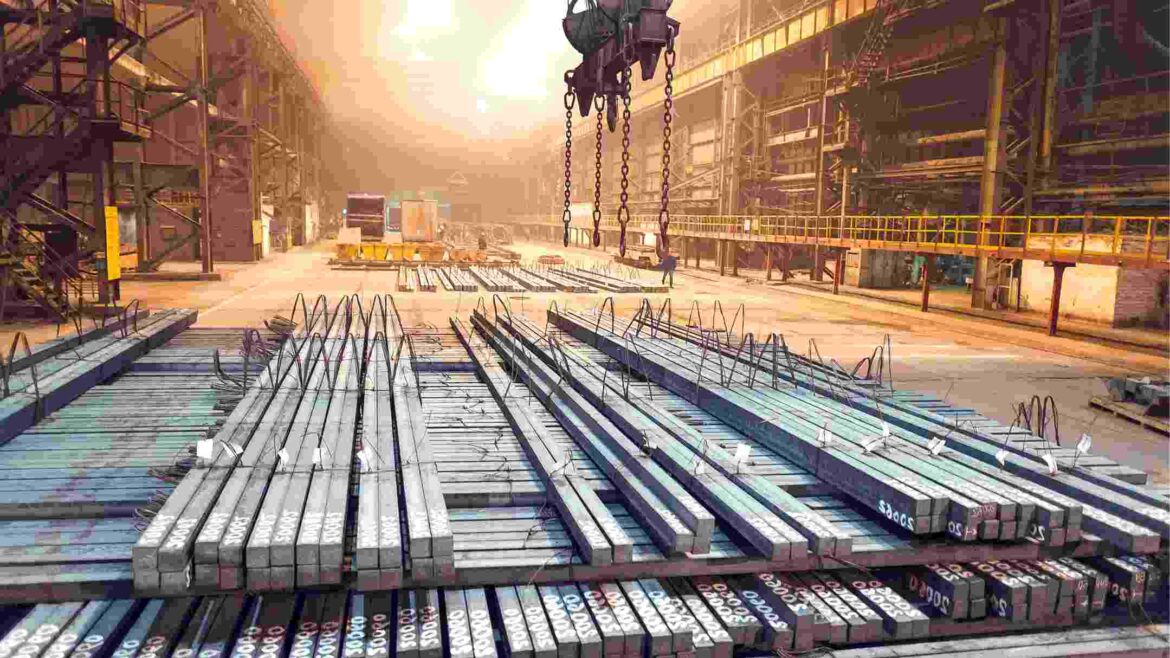

India is the world’s second-largest manufacturer of steel, accounting for around 2% of the country’s GDP, and is on track to become the second most consumer of steel. India’s export production capability and industry have aided the country in establishing a positive steel commerce balance. The Steel industry is the most lucrative sector for business opportunities in the country.

Steel is one of the world’s most versatile alloys, with the added advantage of being easily reused and recycled. The steel industry serves as the backbone of a range of business sectors, including construction, manufacturing, fabrication, automobile components, defence manufacturing, electrical machinery, railways, furniture production, Iron Recycling Business, TMT bar manufacturing and Export-Import. In addition, thousands of ancillary industries depend on this primary industry.

The marketplace is fast-paced, and the competition is fierce. Private financing can get you the capital you need, quickly and efficiently, to propel your business toward success and thrive in this competitive industry.

𝐉𝐏 𝐅𝐢𝐧𝐚𝐧𝐜𝐞

JP Finance is the most trusted private finance company in Chennai. JP Finance offers a hassle-free experience with unsecured business loans at competitive interest rates and flexible repayment options. We provide unsecured business loans exclusively for businesses in the steel industry to expand and evolve into prominent powerhouses.

𝐋𝐨𝐚𝐧𝐬 𝐟𝐨𝐫 𝐥𝐚𝐧𝐝 𝐩𝐫𝐨𝐜𝐮𝐫𝐞𝐦𝐞𝐧𝐭:

Procuring land is a necessary investment especially to set up your enterprise. It is a highly desirable and tangible resource to set up and step up your business journey. If you are looking to acquire unsecured business loans for securing lands, choose JP Finance.

𝐋𝐨𝐚𝐧𝐬 𝐟𝐨𝐫 𝐬𝐞𝐭𝐭𝐢𝐧𝐠 𝐮𝐩 𝐅𝐚𝐜𝐭𝐨𝐫𝐢𝐞𝐬:

Setting up factories, manufacturing units, warehouses, and storage facilities include planning, materials, experts, and workers to construct your fortress of business success. It is a critical financial undertaking. JP finance provides unsecured loans up to 10 crores to help bring your dreams to fruition. Establish your best-in-class facilities with advanced technologies with quick business loans.

𝐋𝐨𝐚𝐧𝐬 𝐟𝐨𝐫 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐌𝐚𝐜𝐡𝐢𝐧𝐞𝐫𝐲:

The Indian steel industry is modern, with state-of-the-art machinery. It has always strived for continuous modernization and upgrading to higher efficiency levels. JP offers unsecured industry machinery loans exclusively to buy the finest machinery and equipment necessary for your business.

𝐋𝐨𝐚𝐧𝐬 𝐟𝐨𝐫 𝐫𝐚𝐰 𝐦𝐚𝐭𝐞𝐫𝐢𝐚𝐥𝐬 𝐚𝐧𝐝 𝐨𝐭𝐡𝐞𝐫 𝐞𝐱𝐩𝐞𝐧𝐝𝐢𝐭𝐮𝐫𝐞𝐬:

Capital flow is still required for everyday business requirements like purchasing raw materials, adding to inventory and stock, paying employees, and other necessities. Unsecured business loans offered by JP finance are especially valuable for this purpose.

𝐋𝐨𝐚𝐧𝐬 𝐟𝐨𝐫 𝐋𝐨𝐠𝐢𝐬𝐭𝐢𝐜𝐬 𝐚𝐧𝐝 𝐃𝐢𝐬𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧𝐬:

Logistics and distribution play a vital part in the success of your business venture. With easy access to unsecured loans at JP finance, develop your logistics channels and improve distributions to be efficient and swift.

JP Finance is the most trusted private finance company in Chennai offering unsecured business loans for entrepreneurs in the steel industry with the unique JP Advantage. JP Finance’s business loans are 100% collateral-free and available at the lowest interest rates, starting at 1.25% per month. The short-term business loans from JP Finance are free of any hidden costs and come with flexible repayment options. The hassle-free loan process allows for a quick turn-around time and is disbursed within 48 hrs of approval.

𝐂𝐡𝐨𝐨𝐬𝐞 𝐉𝐏 𝐟𝐢𝐧𝐚𝐧𝐜𝐞 𝐚𝐬 𝐲𝐨𝐮𝐫 𝐫𝐞𝐥𝐢𝐚𝐛𝐥𝐞 𝐬𝐮𝐜𝐜𝐞𝐬𝐬 𝐩𝐚𝐫𝐭𝐧𝐞𝐫 𝐭𝐨𝐝𝐚𝐲 𝐭𝐨 𝐮𝐧𝐥𝐞𝐚𝐬𝐡 𝐭𝐡𝐞 𝐭𝐫𝐮𝐞 𝐩𝐨𝐭𝐞𝐧𝐭𝐢𝐚𝐥 𝐨𝐟 𝐲𝐨𝐮𝐫 𝐛𝐮𝐬𝐢𝐧𝐞𝐬𝐬!